I was going to write about the growing rat infestation in Greater Sequim, but I can’t resist looking into and for the truth when the opportunity presents.

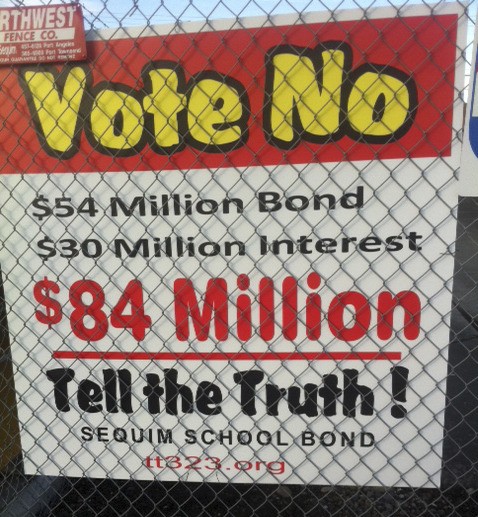

A website has sprouted up in this cold Sequim winter entirely devoted to putting the freeze on the Sequim District School bond. The website is called “Truth in Taxation.” I liked the name, support the concept of truth and, as anyone knows who reads this column, I like facts and that Sequim schools is a favorite topic.

Someone put a lot of work into this website but was apparently too shy name him, her or them. A committee and Sequim postbox was listed, but the omission of names wears a bit on credibility.

Nevertheless, I believe that anonymous truth teller — to whom I will respectfully refer to as ANTTs in the interest of saving space — is sincere in their opposition and in the spirit of their sincerity I began due diligence to learn the facts.

No interest?

“Now, they are asking for $54,000,000 — almost $5 million more than the one in November! With added interest, the amount to be repaid will be approximately $84 MILLION.” Truth in Taxation website

Clearly, ANTTs think the district is being a pest not to take no for an answer and keep asking the community to support a school construction bond. ANTTs seem very surprised to learn that interest is paid to finance the 20-year bond. I dislike being the one to tell this fact to ANTTs because I think they are nice people but they need to know that banks and investors generally don’t invest in interest-free loans.

FYI, I asked Brian Lewis, who is director of Sequim School’s Business Services, and who was quoted as the source to verify and comment on the interest amount quoted. Lewis said that the actual total interest costs are estimated at $40 million. Note to ANTT — verify next time.

Does 42 percent of paying off a 20-year loan shock any homeowner who pays an average 51 percent of the full repayment of a 30-year loan in interest?

Make do?

“The schools, apparently, have not been properly maintained over the past 10 years, despite various maintenance and operation levies being passed and paid for property owners.” Truth in Taxation

Operations and maintenance levies have passed in the last decade; however ANTTs seems to have a misunderstanding. They may be thinking that operations and maintenance levies are intended to pay for significant remodels and updates for heating systems, leaky roofs, ventilation, lighting, power sources and space needed for modern educational facilities to keep up in areas such as science and computer technology.

I will help clarify this because we all want the truth exposed. School bonds and levies have distinctly different purposes. Bonds do not support operations; they are intended for construction. Levies do not support construction; they are intended for operations. Expenditures like improving transportation vehicles have a specific designation just like construction is designated spending listed on Truth in Taxation website.

Maintenance crews, by definition, do not rewire buildings any more than they redo the plumbing for old water systems and ancient nonfunctional water fountains or replace roofs. The crews are not asked to rebuild an elementary school.

They are asked to maintain facilities in good working order but equipment, systems and buildings have a shelf life and a time beyond which they can no longer be repaired or support current use. A small example is the broken steamer kettle in which soups, sauces and pasta are prepared or were until the day parts were no longer available. Bigger examples are leaky roofs, inadequate power to support modern equipment and one-stall little girls bathroom used by at least four classes.

Sometimes, it is more cost effective to simply put on a new roof. Sometimes, it more cost effective to simply build a new building than to prop up a decaying elementary school and multiple portables of varying ages that were used by thousands upon thousands of energetic young children.

Besides, there is a high cost of inefficiencies and waste of resources as the district adapts year after year to inadequate and unsafe facilities. Money drifts into the dry hole of continuous repair and staff do rework in order to manage inefficient space.

I am not persuaded that decades of maintenance will preserve the useful life of a building serving a dynamic changing environment. Offhand I can’t think of a successful business that doesn’t reinvest except those that didn’t and didn’t survive or, perhaps ancient mausoleums.

Misinformation and misdiagnosis

“We are told that the student population is increasing. Ten years ago, the student population was 2,900. Today it is 2,600. That’s almost a 10% DECREASE in overall student population.” Truth in Taxation website

Here are the facts based on the record of 12 years of enrollment statistics. Enrollment for school year 2004-2005 was 2,798 students and 2014-2015 was 2,689. Lewis projects the current year enrollment to total 2,735.

Even, if ANTT’s figures were right, I don’t understand why remaining students shouldn’t have water fountains or bathrooms.

ANTT’s website reserved a separate section that referred to Gov. Inslee’s proposal to bring more refugees to the state and leaped, as in somersaulting over logic, to this conclusion.

“And if so, how many of the refugees will have children that will need to be schooled, at government (taxpayers’) expense?

Is this why the school district is saying that there will be “more” students enrolled, when the current statistics show a decline?” Truth in Taxation website

I don’t know how to respond to the intelligence behind this statement.

And last,

“Bond proponents’ claim that we need to build new schools to attract doctors is mistaken. Doctors don’t need to rely on public schools for their family’s education. Doctors could use private schools, tutors or home schooling for their children.” Truth in Taxation website

I’m speechless.

Bertha D. Cooper is retired from a 40-plus year career as a health care administrator focusing on the delivery system as a whole. She does occasional consulting. She is a featured columnist at the Sequim Gazette. Reach her at columnists@sequimgazette.com.